Fully Reserved

Tokens are collateralized and represent legally enforceable claims to the underlying stocks.

Tokenized Stocks

Tokenized stocks are fully backed digital assets, redeemable for stocks of public companies.

Tokens are collateralized and represent legally enforceable claims to the underlying stocks.

Digital Identities ensure a safe and regulated ecosystem.

Use tokenized stocks in DeFi to earn yield, unlock utility, and access new financial opportunities.

Claim dividends in USDC, even when your stocks are deployed in DeFi protocols.

Choose from popular stocks like Apple and Tesla, and own a slice of some of the world’s most iconic companies.

Access next-generation financial applications with greater efficiency and transparency — powered by blockchain.

Explore Ecosystem

Reserves are held by a qualified custodians and is audited by an independent firm on a regular basis.

Tokenized stocks meet the highest regulatory standards, ensuring full shareholder protections.

DCLEX empowers developers to build next-generation financial applications using tokenized stocks.

Tokenized stocks are blockchain-based tokens fully backed by company shares, such as Apple or Tesla, held by qualified custodians. They combine the economic benefits of traditional equities with the speed and flexibility of digital assets, offering fractional ownership, instant settlement, 24/7 access, and DeFi interoperability, empowering a more inclusive, efficient, and transparent financial ecosystem.

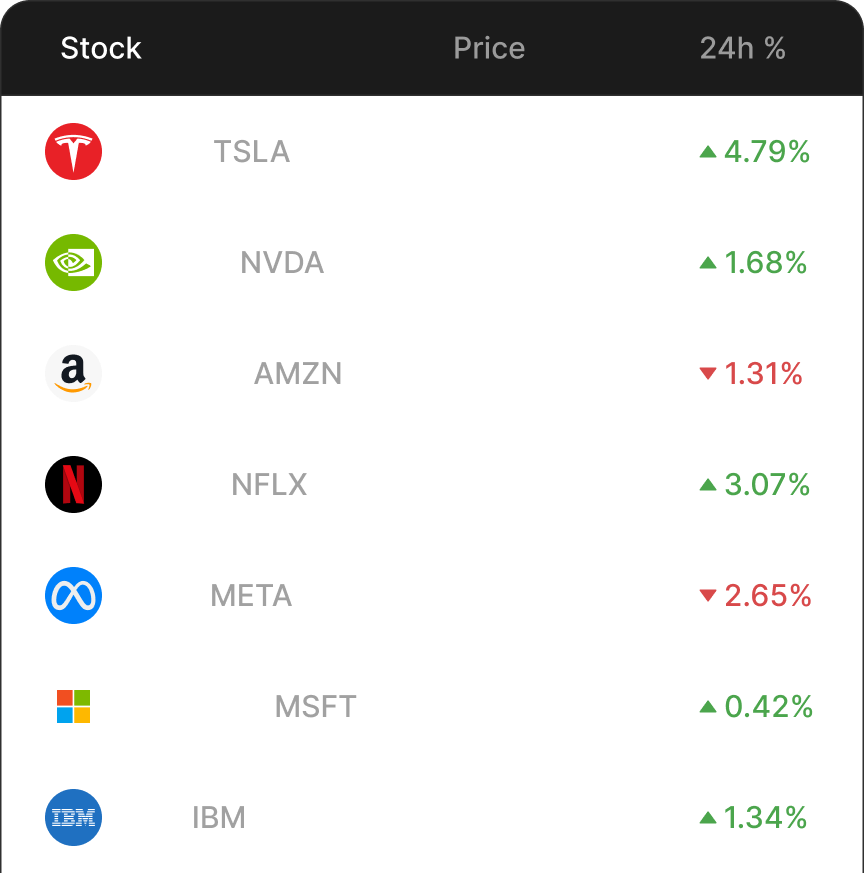

DCLEX currently offers the following tokenized stocks:

| # | Name | Symbol | CUSIP |

|---|---|---|---|

| 1 | Apple | AAPL | 37833100 |

| 2 | Tesla | TSLA | 88160R101 |

| 3 | NVIDIA | NVDA | 67066G104 |

| 4 | Amazon | AMZN | 023135106 |

| 5 | Microsoft | MSFT | 594918104 |

New listings will be introduced over time, with announcements made via DCLEX’s official channels.

Anyone with a Digital Identity can acquire tokenized stocks on the DCLEX Exchange or through authorized distribution partners. On DCLEX, simply connect your wallet and swap USDC or supported crypto for tokenized stocks at live market prices. Trades settle instantly, and you will receive the tokenized stocks directly in your wallet.

You can earn yield by providing liquidity to DCLEX’s decentralized exchange pools or by lending your tokenized stocks in approved DeFi protocols. Liquidity providers earn a share of trading fees, while lending can generate interest—allowing you to put your stocks to work and earn passive income, even while holding them on-chain.

Yes. Tokenized stocks deliver full dividend distributions, even when they are used in DeFi protocols such as providing liquidity. Dividends are paid in USDC and can be claimed in the Portfolio section of your DCLEX account.

DCLEX tokenized stocks are available on Ethereum. Expansion to EVM-compatible Layer 2 networks is planned to offer a faster, cheaper, and more accessible on-chain trading and investing experience.