Regulatory Compliance

Tokenized stocks operate in a regulated environment, providing full shareholder rights and protections.

DCLEX Mint

DCLEX Mint is the fastest, most cost-effective way for institutions and distributors to mint and redeem tokenized stocks.

Launch Mint

With DCLEX Mint, institutions and distributors can issue tokenized stocks directly at scale—reducing costs, friction, and third-party complexity.

Tokenized stocks operate in a regulated environment, providing full shareholder rights and protections.

Trades are executed on traditional markets, ensuring deep liquidity and reliable execution.

Instantly mint tokenized stocks on-chain, enabling 24/7 access and distribution.

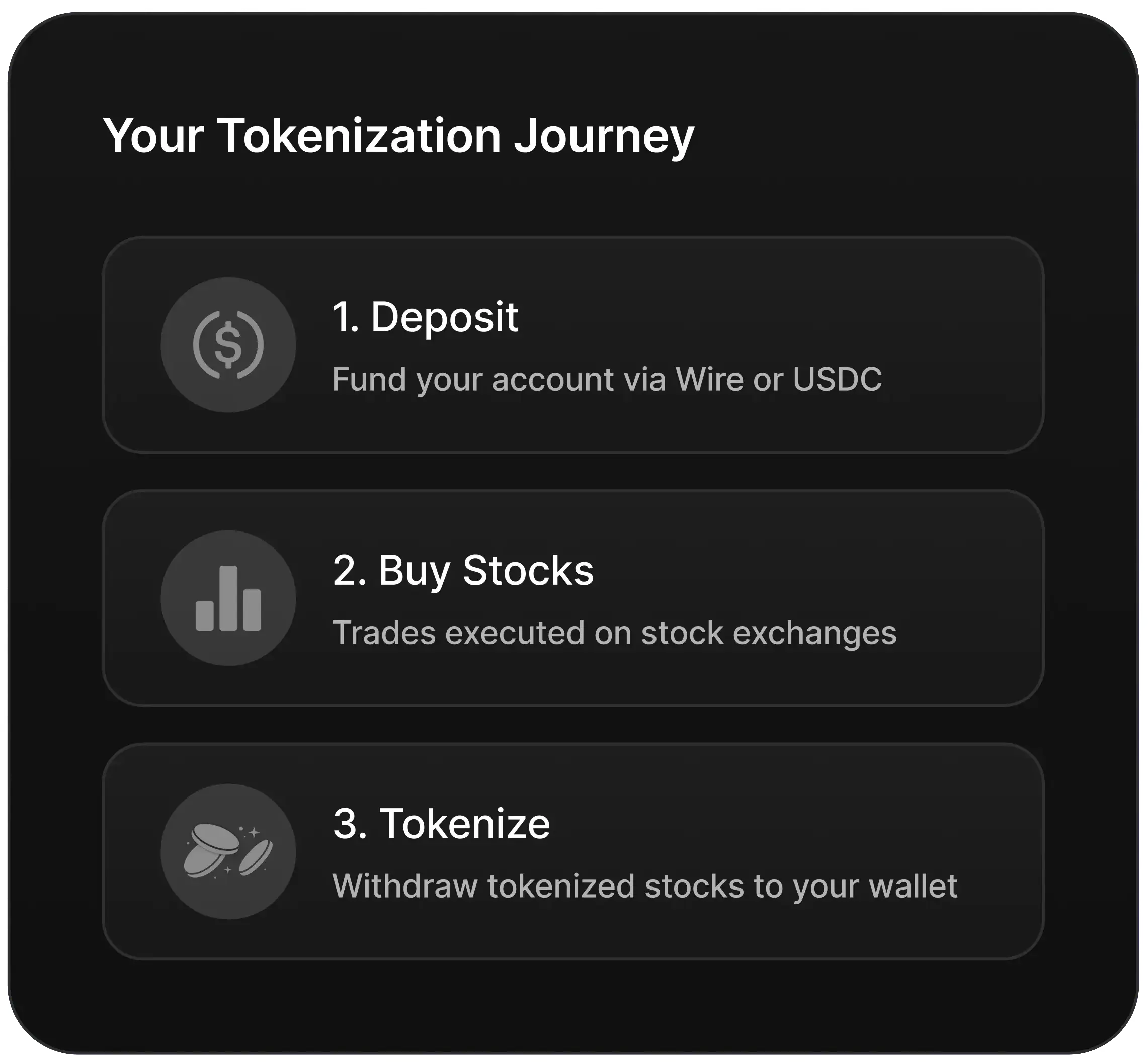

Buy and sell stocks via traditional exchanges, then withdraw your positions as tokens to your wallet.

Tokenize and trade stocks directly in your platform with our developer-ready APIs—seamlessly integrate and automate.

Explore DocsDCLEX Mint is built for institutions, asset managers, and distributors minting high volumes of tokenized stocks. Available with funding via wire or USDC. Retail users can access tokenized stocks through our DEX or trusted distribution partners.

Apply for DCLEX Mint

Tokenized stocks on DCLEX are always 100% backed and redeemable for traditional shares. Redemption is available to eligible institutions and businesses via DCLEX Mint.

Redeem now

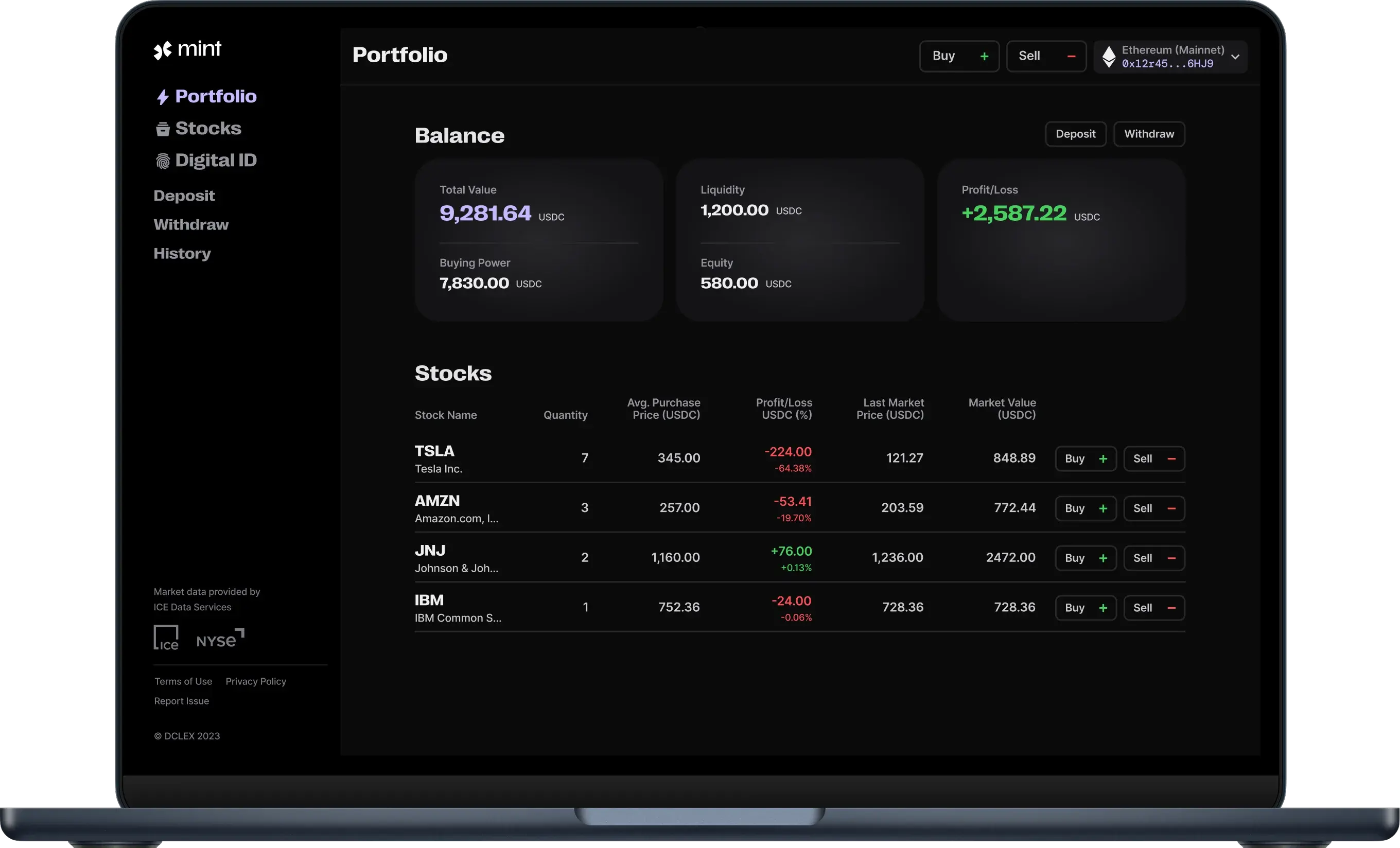

DCLEX Mint is an institutional-grade tokenization platform for public equities that enables authorized DCLEX partners to issue and redeem tokenized stocks on the Ethereum blockchain. It operates like a traditional trading platform, allowing the buying and selling of stocks, with the added ability to withdraw tokenized stocks to an Ethereum wallet or deposit them back for redemption into traditional shares.

DCLEX Mint is available to authorized DCLEX partners, including financial institutions, asset managers, and distributors within DCLEX’s operational jurisdictions. All DCLEX minting partners must complete a thorough review process, including background checks, KYB verification, and sanctions screening, before being approved for access.

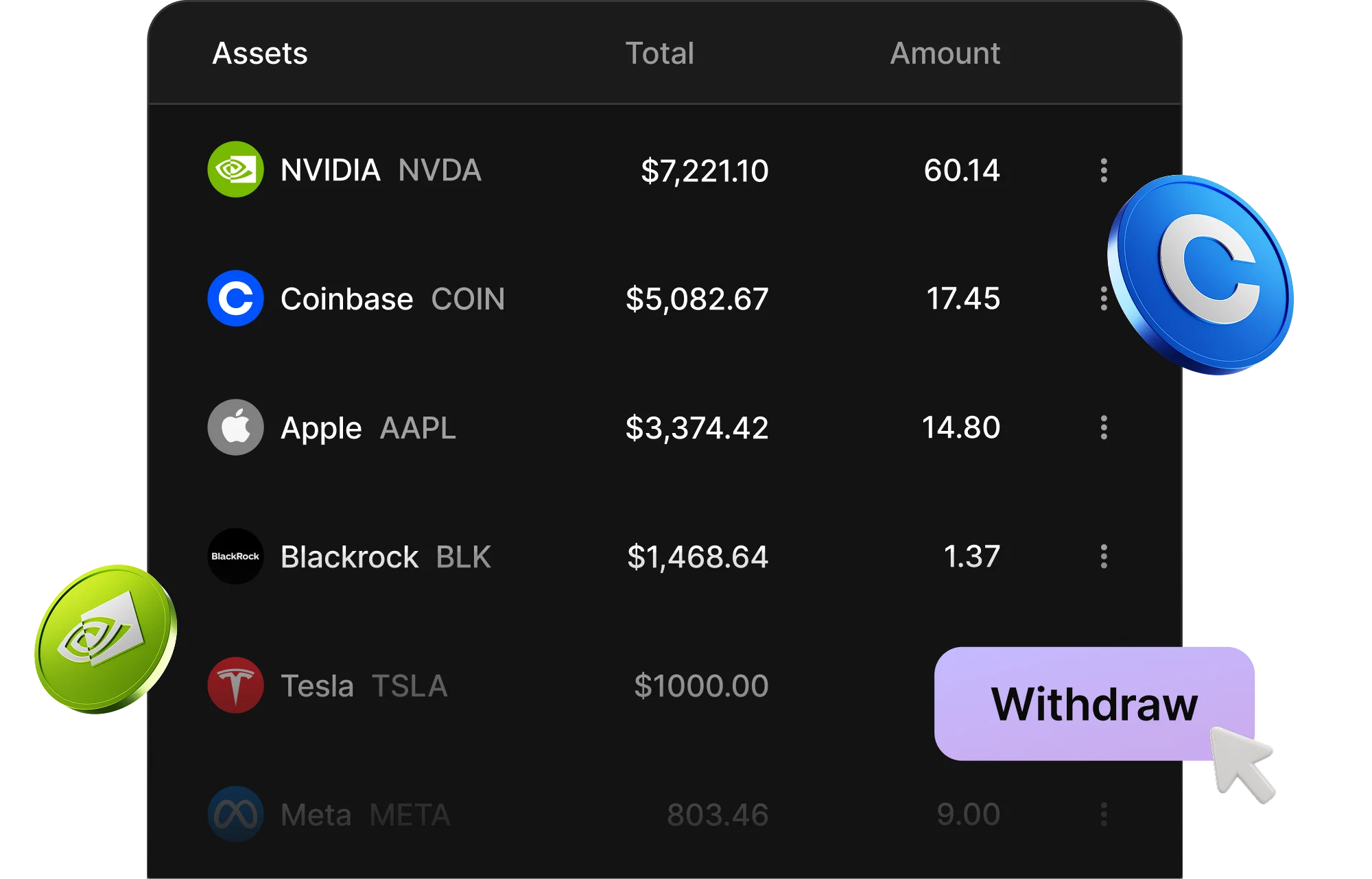

Authorized Mint partners can fund their DCLEX account with USDC or by Wire transfer. Once funded, they can buy and sell supported stocks through a trading-platform-style interface. Orders are executed via our broker on traditional exchanges, with the shares held in an omnibus account by a qualified custodian.

Tokenization occurs when a user withdraws shares from their DCLEX account. The equivalent number of shares is deducted from their balance and minted as tokenized stocks, sent directly to their Ethereum wallet.

Redemption works in reverse. Users can deposit tokenized stocks to their DCLEX account, burning the tokens and crediting their account with the corresponding shares, which can then be sold on the platform.

Note: DCLEX Mint supports only whole stock units for withdrawals and deposits.

Trading on DCLEX Mint is available 24/5 (Monday to Friday) in alignment with U.S. market hours and settlement infrastructure. Withdrawals and deposits of tokenized stocks are available 24/7.

DCLEX Mint charges 0% fees for trading and tokenization.

Standard Ethereum gas fees apply for withdrawals and deposits of tokenized stocks.